Strategies for insurers to manage new communication technology

...

Refine insurance offerings to cater to tomorrow’s digital demand. Adopt secure, compliant, and digitally-enabled operating models to improve the experience of customers, employees, stakeholders, and other partners.

Nuvento’s insurtech solutions fast-forward digital adoption in insurance. Leverage AI, RPA, and Cloud technologies to modernize the insurance infrastructure, consolidate the customer service operations, upgrade the agent management system, and expand on the product delivery model.

Digital processes are fast replacing traditional practices. And most businesses have adapted to the new model, by moving their systems online and supporting their customers with basic functionalities.

As customers’ preferences shift to a solely digital model, insurance agencies must remodel their offerings and deliver them to customers on the platforms they’re on.

Nuvento’s digital insurance solutions help insurance agencies analyze their existing offerings, evaluate how to build on them to meet the future demand, and incrementally adopt solutions to transform offerings to digital.

Insurers are adopting unique strategies with innovative insurance IT solutions to achieve continuous strategic advantage. Nuvento’s digital insurance solutions allow insurers to improve customer engagement, establish new business models, and offer innovative products by leveraging the power of technology and data.

Modernizing legacy systems and cutting through data silos to build integrated data models.

Improving existing insurance processes and business models using digital technologies.

Employing a digital-first strategy, where data stays digital and is available from anywhere at any time.

Nuvento’s digital insurance solutions are built to reduce the time taken to settle a claim. The process focuses on delivering anywhere anytime access to customers to file claims and minimize human intervention.

The solutions are built to help insurers and their customers ease through the claims processing journey by leveraging digital channels and minimizing traditional practices, vastly simplifying the process. With intelligent chatbots, AI-based image and documentation solutions simplifying access to information and data, our solutions eliminate traditional process bottlenecks and quickly process claims for speedy settlement.

Receive, validate, and resolve claims – right from FNOL to settlement – in no time.

Improve claims processing speed with minimal human touch-points for low-cost claims.

Intimate the agency of the first notice of loss via digital and AI-based chatbots, policy wallets, and websites instantly.

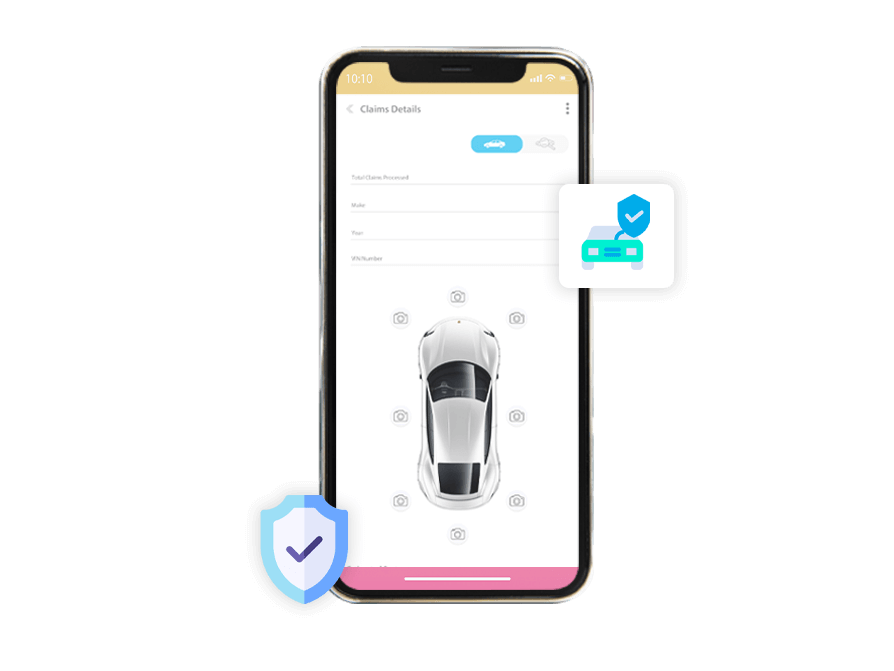

Advanced AI-based image recognition capabilities analyze vehicle damages and calculate estimates for repairs.

Algorithm for complexity-based claims triaging to the right adjusters. Triage analytics for faster responses to FNOLs.

Convert FNOL forms submitted in paper formats to digital versions. Efficiently manage claims-related documentation.

AgentConnect is a powerful portal for insurance agents on the cloud that consolidates the agency’s knowledge to deliver real-time insights that improve agents’ performance.

The portal gives agents real-time insights into performance metrics, helping them improve their productivity. They can stay updated on policy changes with quick and easy access to all the relevant information and agents can manage their customers, leads, targets and much more on this platform.

NuOCR is an AI-based optical character recognition- enabled documentation system that instantly transfers data on document – paper/digital – to the database.

The template-based system eliminates the need for paper documentation by extracting data from paper, validating it and organizing it in your database in a few simple clicks. NuOCR helps insurance businesses organize their customer information in the database, simplifying CRM needs.

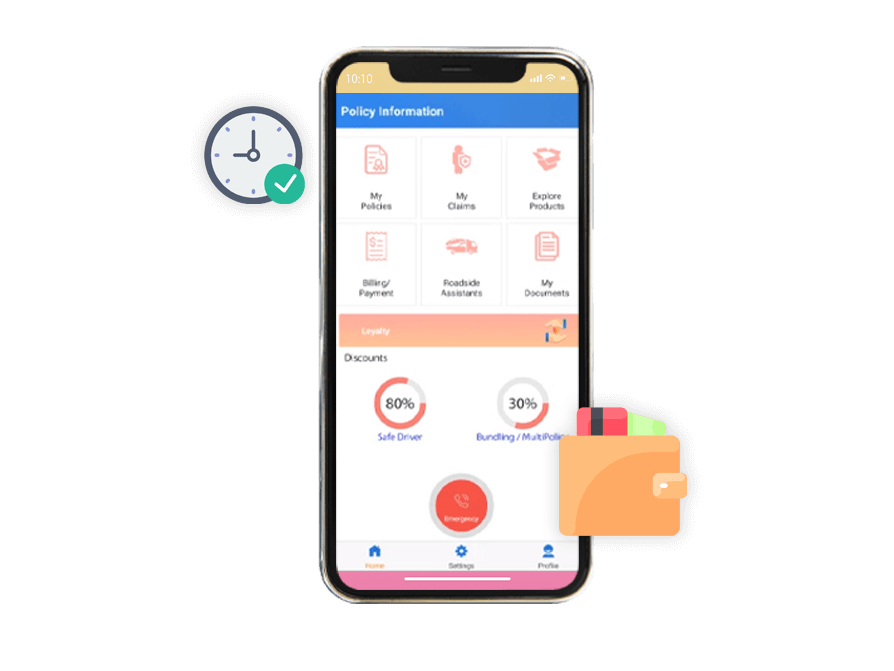

Letting insurance customers know everything they need to about their insurance policies. The policy wallet reduces dependency customers have on the insurance agent/broker for fulfilling insurance-related needs and gives them a channel with self-service capabilities.

Doing away with paper documents and waiting in queues for claims filing processes, customers can file claims, check policy statuses and claims process updates on a single channel, giving them complete control over their insurance needs.

CarDE is an AI-powered vehicle damage estimation system that leverages image analytics for real-time damage assessments. The system evaluates images and generates estimates for damage repairs, making the process consistent and delivering timely cost-estimates.

Process consistency minimizes opportunities for fraud and improves operational efficiency of the insurer.

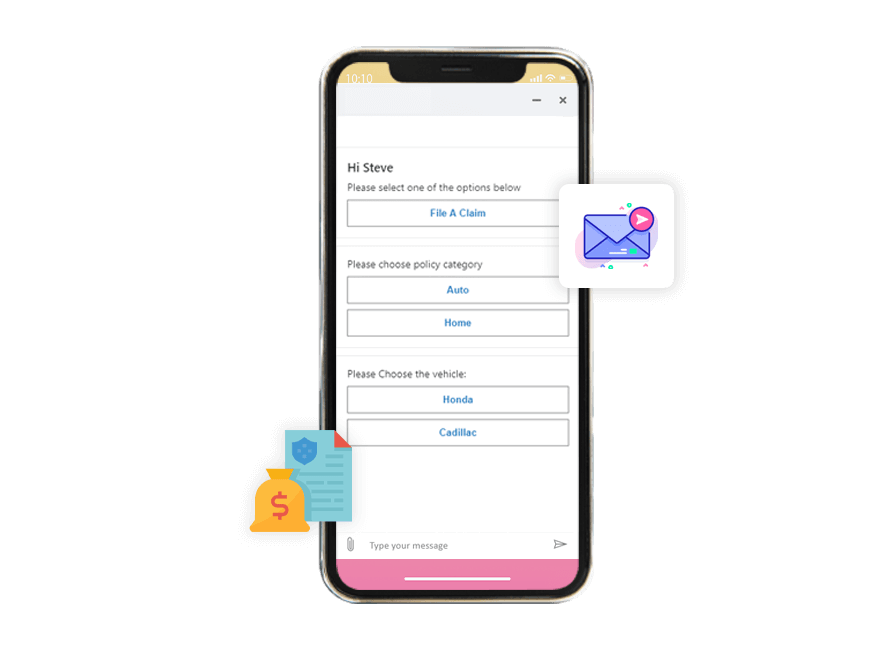

AI-enabled conversational chatbot built with AI, ML and NLP capabilities to simplify customers’ experience of filing a claim. The chatbots works as a digital claims’ assistant that collects relevant information once an insured customer expresses the intent to file a claim.

The chatbot collects details around the type of insurable event, location, images and guide the user to the next course of action.

We assist insurance agencies in utilizing cost-effective digital strategies while remaining sustainable.

Our insurtech product frameworks can speed up your digital insurance offering development letting you meet growing customer and business needs .

Our digital insurance product frameworks are developed in adherence with the latest security standards and current market regulations.

We have worked with several big insurance firms and have collaborated in several digital transformation projects giving us an understanding of how the industry works.

Insurtech solutions are technology solutions designed to revolutionize and improve the efficiency of the current insurance industry model. Insurtech is a combination of the word insurance and technology. Insurtech solutions bring in customized- and user-centric technology applications to simplify customers’ access to timely, accurate, and cost-effective business intelligence and support the claims management lifecycle.

Insurtech represents the commitment to innovation and development of technological products and services in the insurance sector. Its use expands and optimizes the busniess model of an entire sector. As an industry closely related to banking and finance, which has been intensely focusing on FinTech, the insurance sector needs to modernize, digitize and grow by taking advantage of upcoming and innovative technology. This will then help to meet the present and future customer demand.

Insurtech software are innovative software solutions and platforms built for stakeholders in the insurance industry that are created and implemented to improve the efficiency of the insurance industry. Insurtech solutions power the creation, distribution and administration of the insurance business.

Insurtech companies innovate and bring in disruptive changes to the insurance model, leveraging deep learning, trained artificially intelligent models to simplify tasks for brokers and agents and help them provide more curated policy information to customers. It includes software solutions that use these technologies to find the right mix of policies, prices and so on to complete an individual’s coverage.

Insurtech platforms enable all stakeholders in the insurance industry with a connected digital insurance ecosystem, giving them access to a broad set of insurance services, data, capabilities and much more.

Nuvento’s digital insurance portfolio of services help to enhance the operational efficiency of core insurance processes such as finance, procurement, agent/broker management while reducing cost and boosting customer as well as employee satisfaction.

Our insurtech solutions are tailored to meet the day-to-day requirements of a wide range of insurance services, which include health insurance, auto insurance, life insurance, property and casualty insurance.