17 Jan Top 7 Data Science Use Cases in Insurance Industry – Infographics & Video

Insurance companies are now rapidly undergoing a digital transformation. With insurance digital transformation , a wider range of information is available to the insurers. Data science helps insurance companies to put these data to efficient use to drive more business and refine their product offerings.

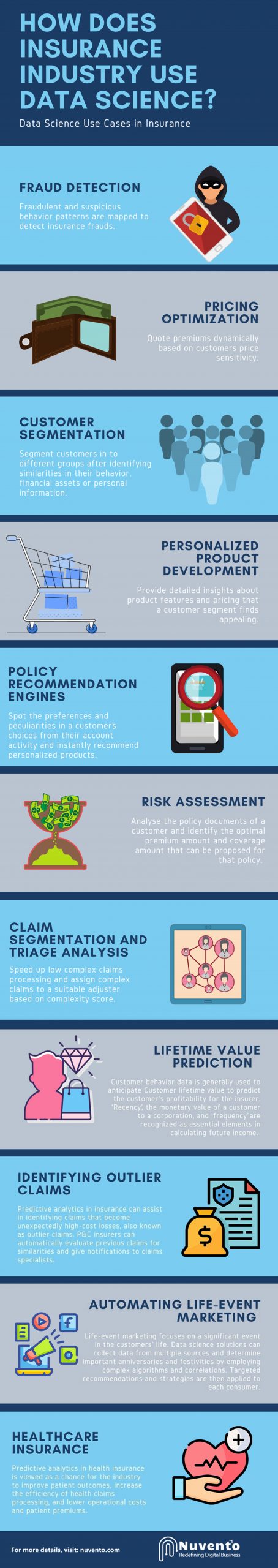

Data science can enable insurers to develop effective strategies to acquire new customers, develop personalized products, analyze risks, assist underwriters, implement fraud detection systems, and much more.

Below are some detailed data science use cases that explain how the insurance industry is using data science to grow their business.

If you are in a hurry, you may skip to our infographics on “How does the insurance industry use data science?”

Fraud Detection

Insurance fraud results in a vast financial loss to the insurance companies. Subtle behavior patterns can be mapped to detect fraudulent activities using data science platforms.

Usually, insurance companies feed the fraud detection algorithm with statistical models that rely on previous cases of fraudulent activities. Predictive modeling techniques can be applied here to identify fraud instances by analyzing the links between suspicious activities and recognize fraud schemes that were not noticed before.

Pricing Optimization

Data scientists help insurers to quote premiums dynamically so that it’s closely related to the customer’s price sensitivity. Price optimization increases retention rates and customer loyalty.

Customer Segmentation

Data scientists are easily able to segment the customers of an insurance agency based on their financial assets, age, location or any other demographic. Classifying customers to different groups after identifying similarities in their attitude, preferences, behaviour or personal information allows insurance companies to develop products that are appealing and helpful to each group. This results in targeted cross selling capabilities and launching personalized products that can be marketed efficiently.

Personalized Product Development

Digitization in insurance has enabled the insurers to extract valuable insights from the vast amount of demographic data, preferences, interactions, behavior, lifestyle details, interests, etc of the customers using artificial intelligence and advanced analytics. Customers love personalized policy offerings which suit their needs and lifestyle.

Data science can provide detailed insights about product features and pricings that a customer segment finds appealing. The ability to develop such personalized products that suits the requirement of customer segments is what differentiates insurTechs from traditional insurance providers.

Policy Recommendation Engines

We have already learned that data science can assist insurers in developing personalized products which are more appealing to the customers. Recommendation engine algorithm can spot the preferences and peculiarities in a customer’s choices from their account activity and instantly recommend personalized products to increase the upselling and cross-selling revenue.

Risk Assessment

Risk assessment can significantly reduce the losses in insurance. Insurance underwriting is one area where risk assessment solutions can be implemented to reduce the losses. The underwriter’s ability to identify the risks involved in insuring a customer or an asset will impact the business directly. Data science can pave way for AI and cognitive analytics enabled systems that can analyse the policy documents of a customer and identify the optimal premium amount and coverage amount that can be proposed for that policy. This will significantly enhance the efficiency of underwriters and low risk policies can be quickly processed.

Claim Segmentation and Triage Analytics

Claim segmentation and triage analysis is the process of analysing the complexity involved in each claims and assigning them a score based on the complexity level. This process largely helps the insurance companies to reduce the claim processing time by fast tracking the low complex claims and assigning the more complex claims to a suitable adjuster who have experience to deal with the complexity. This solution will also help insurers to efficiently utilize the claim adjusters.

Lifetime Value Prediction

Client lifetime value (CLV) is a complex matter that represents the value of the customer to a firm in terms of the difference between revenues gained and expenses incurred predicted over the entire future relationship with a customer. Customer behavior data is generally used to forecast the CLV to predict the customer’s profitability for the insurer. Modern predictive analytics systems conduct a comprehensive and well-rounded study of multiple data points to make intelligent pricing and policy decisions. Cross-selling and retention are frequently forecasted using behavior-based models. ‘Recency’, a customer’s monetary value to a company, and ‘frequency’ are recognized as essential criteria in calculating future income. To generate the prediction, the algorithms combine and process all of the data. This enables forecasting the possibility of client behavior and attitude, policy maintenance, or a policy surrender. Furthermore, the CLV prediction may be valuable for developing marketing strategies because it provides you with client insights.

Healthcare insurance

Healthcare insurance is a broadly used insurance practice in all countries of the world. The insurance covers all costs caused as a result of disease, accident, disability, or death. In most countries, governments strongly support healthcare insurance policies. In the digital age, when information influences all sectors of the globe, this domain is unable to withstand the immense influence of data analytics applications. Insurance companies are constantly striving to deliver better services while lowering costs, which makes health care analytics and data science in insurance a critical component in achieving those objectives. Because of the current developments with digital technologies, the global health care analytics market is constantly developing.

A wide variety of data is obtained, formatted, processed, and translated into valuable insights for the medical insurance sector, including insurance claims data, membership and provider data, benefits and health records, client and case data, internet data, and so on. As a result, areas such as cost savings, quality of service, fraud detection and prevention, and increased consumer involvement may all improve dramatically.

Automating life-event marketing

In the extremely competitive insurance sector, insurance companies are always vying to recruit as many consumers as possible through numerous channels. To reach their objectives, businesses must employ a wide range of marketing techniques. Automated marketing has reached a peak in this regard – automated marketing is crucial for acquiring information about clients’ thoughts and behaviors. Since the primary objective of digital marketing is to reach the right person at the right time with the correct message, life-event marketing focuses on a specific event in the consumers’ lives. Insurers can collect data from different sources and pinpoint important dates and festivities using data science approaches. Targeted ideas and methods are then deployed using complicated algorithms and associations. Insurance firms ensure a steady supply of customers matching a wide range of their ideas by tracking the consumer as they go through the life cycle.

Identifying Outlier Claims

Predictive analytics in insurance can help in identifying claims that unexpectedly become high-cost losses, also known as outlier claims. P&C insurers can use analytics technologies to automatically examine past claims for similarities and give notifications to claims specialists. Advance notification of potential losses or difficulties can help insurers in reducing these outlier claims. Predictive analytics for outlier claims does not have to be used only after a claim has been filed; insurance firms can utilize outlier claim data to create plans to deal with similar claims in the future.

Download Digital Insurance Brochure for Detailed Features

To achieve complete digital transformation in the insurance industry you need a technology partner to guide you through the technology landscape and to help you choose the right strategy. Nuvento’s digital insurance services are a portfolio of services that helps to enhance the operational efficiency of core insurance processes such as finance, procurement, broker management, and customer support while reducing costs and boosting customer as well as employee satisfaction. We are not just a tech company, we know the insurance domain so well that our technology solutions cover all the day to day business processes and analytical needs of life insurance, P&C Insurance and auto insurance.

Download Our Brochure to Understand the Key Features and Offerings of Our Insurance Digital Transformation service.