10 Sep Strategies for insurers to manage new communication technology

Insurers are gradually transforming how they’re carrying out everyday operations. The industry which predominantly followed a traditional model of communication, like in-person meetings and paper-based documentation, is today pivoting from that model to accommodate digital tools and practices that enable efficient remote working.

Digital tools are enabling insurers to efficiently communicate and collaborate with their prospects, customers, co-workers and others. And as a whole, the new way of working has been shaking things around – right from how communications are managed to documentation.

Today, there are a plethora of platforms that allow insurers to get started with, there are several enterprise applications that support functionalities such as business messaging, chatting, collaborating, document management, agent management and more, and it presents insurers with multiple channels on which they can communicate with their teams or their customers and manage their everyday activities.

Most channels offer similar functionalities, which leaves insurers with one question: Which platforms should I be using for effectively communicating with my team members as well as my customers and prospects? Insurers must also have an answer to: What are the perfect integrated services I need to be using to win in the new normal?

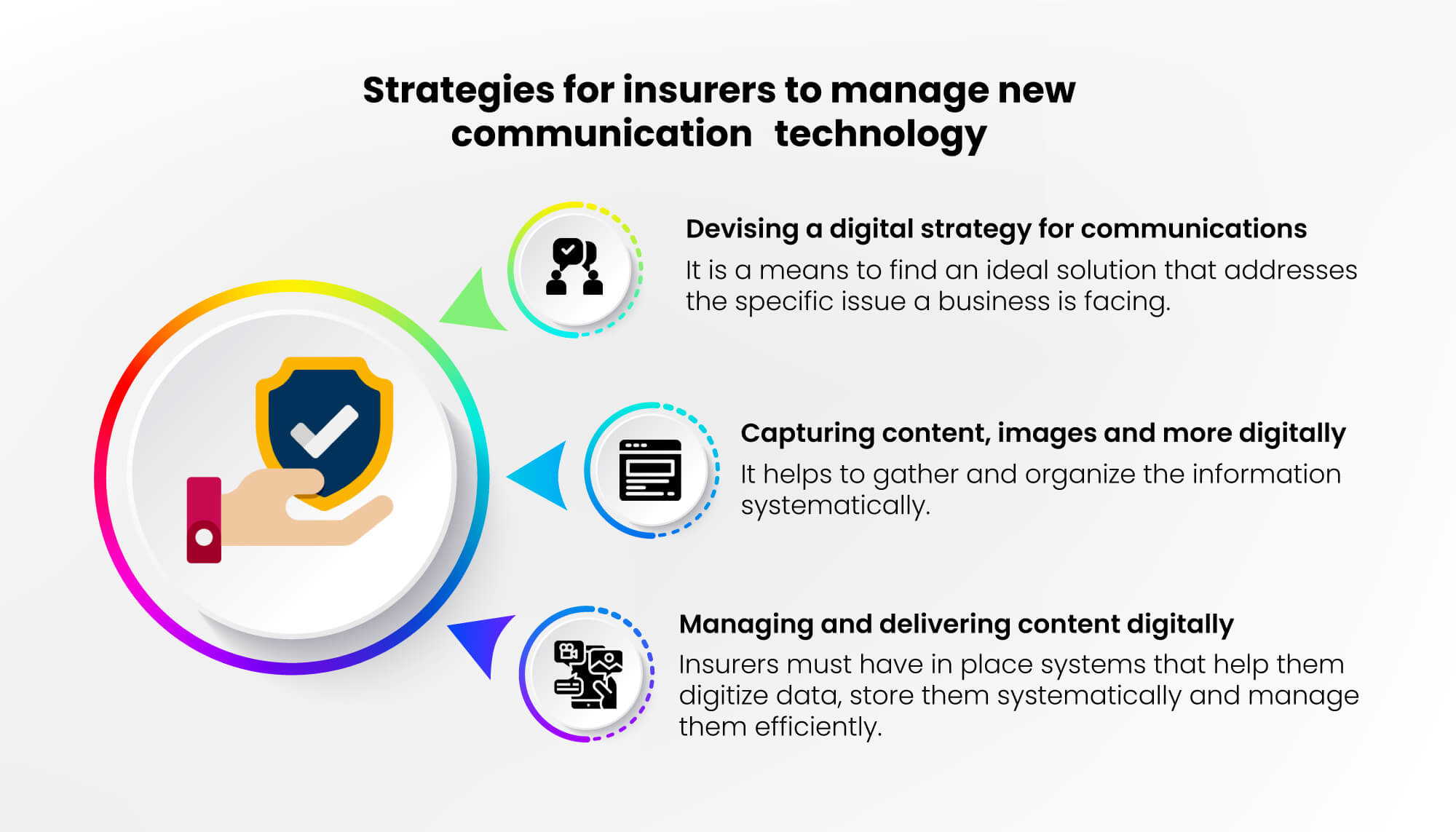

Devising a digital strategy for communications

Strategy revolves around a business’ specific need. It is a means to find an ideal solution that addresses the specific issue a business is facing. The same goes for insurance communications. Each insurer needs to identify gaps within the system to identify which solution would be appropriate.

As with most industries, teams within an insurance enterprise work in silos. Each team would have a specific tool that solves that team’s specific issue. Data from those systems would not be available readily to the other teams within the enterprise owing to a lack of collaboration and integration of the team-specific systems.

In such cases, as more enterprises go digital and rely on integrated offerings that helps every member be on the same page, the competition gets stronger. Enterprises must step up communications and collaborations within teams by making data available on a common platform. They should make data available to teams via self-service capabilities and chatbots. They should also develop capabilities around communicating over digital channels for delivering customer documents, policy documents and so on.

Capturing content, images and more digitally

Digital portals to manage inbound communications makes FNOL submissions, damage image capturing and more convenient for the insurer. It helps to gather and organize the information systematically, without the hassles of scouring through scores of paper forms and documents.

The platform should also easily integrate with the enterprise’s data sources and enable insurers to manage policy forms, customer communications and more. Capabilities should also involve digitally negotiating a settlement with policyholders.

Managing and delivering content digitally

Managing content on digital platforms and using it efficiently while communicating with customers is an important capability for insurers. Insurers must have in place systems that help them digitize data, store them systematically and manage them efficiently with their digital systems. In a world of many digital delivery options, the platforms insurers use must align all the data coming from multiple digital media like applications, online portals, paper documents and more.

Insurers must put in systems that can align traditional and modern data platforms. Platforms must be able to accommodate traditional data sources and platforms and modernize the data infrastructure of the agency.

Nuvento’s Solutions for the Insurance Industry

Nuvento suite of solutions are meant to help insurers fastrack their transformation to managing data and communication on digital platforms.

Nuvento’s Agent Portal is a platform developed for agents. It allows insurers to manage agents’ tasks and enables agents to stay on top of their activities. The Agent Portal gives agents quick access to all the data they need to manage customer communications, target prospects with the right messages and gives tips to help agents improve their performances.

Nuvento’s Policy Wallet is a framework for the customer with self-service capabilities giving them instant access to the information they want. They can even manage much of the insurance-related activities like paying premiums, get queries sorted by asking questions to a chatbot and more.

Nuvento’s chatbot framework can be used across industries to deliver on-the-job training and assistance, and service support to employees. It integrates with various channels and uses the power of machine learning and image analytics to provide real-time work support. The framework can also be used as a customer facing system to help them with their queries.

CarDE is an AI-powered automotive damage estimation platform that leverages image analytics and machine learning frameworks to process automotive damage claims and improve the insurer’s response to customers without changing any existing systems or capabilities. The image analytics and ML capabilities are used to gather images, perform image classification, real-time anomaly detection and estimation.

NuOCR by Nuvento is an online AI-powered paper-to-digital enterprise OCR solution for organizations that digitizes heavy loads of data, such as images, pdf documents or any form of paper. It recognizes and extracts information from documents. And it lets users verify and edit, organize it in the database or download it. This makes it an ideal solution for organizations that need to quickly digi-tize heavy loads of paper data and organize it in the database. NuOCR is now available on the Microsoft Azure Marketplace.

To know more about our digital solutions for the insurance sector, get in touch.