05 Feb Technology and Disruption in the Insurance Sector

Digital transformation is changing not just business processes, but every little aspect of life. There is so much that has been discussed and debated about how digital transformation will impact human workforce and jobs. However, one cannot deny the superior level of convenience and precision digital technology has engendered, resulting in drastic changes in how businesses work, savings in costs and improved time management. Digital transformation has improved on existing process and has also given rise to new possibilities for business.As the business world adopts digital capabilities into its functions and processes, they’re beginning to leverage the possibilities presented by improved process efficiencies, speed, data analytics and service improvements and to improve their services. A survey by Tech Pro Research has found that almost 70% of companies have either employed digital technology to simplify their processes or are in the process of implementing one.

What is insurtech and what are its top trends?

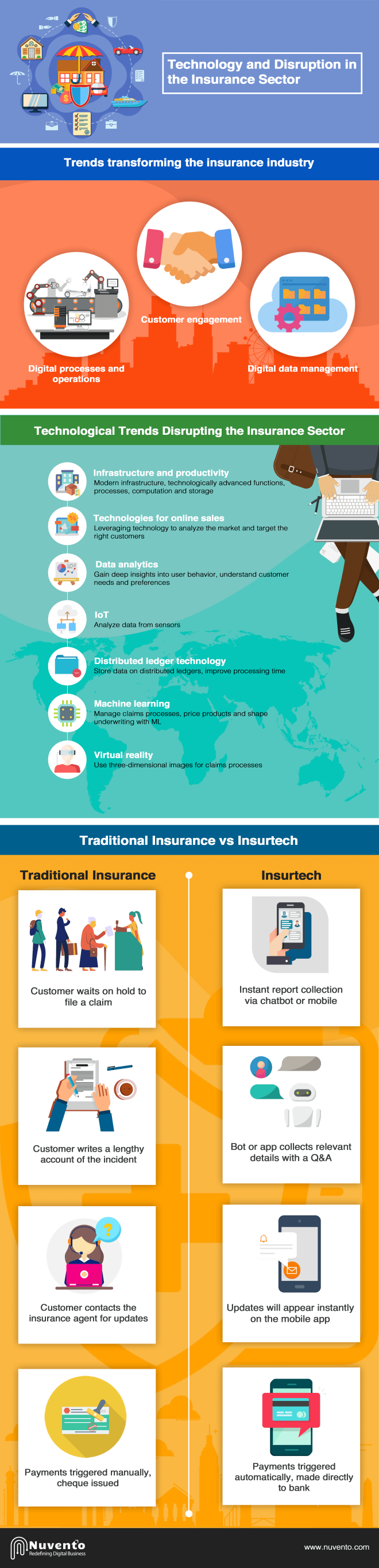

The insurance sector too has been facing major disruption, with its core offerings being radically transformed as a result of digital transformation. The growth of mobile technology has redefined how insurance processes are undertaken by presenting new means of distributing insurance products and claims applications for services like underwriting, risk management and product distribution. These digital transformations in insurance have given rise to a new tide of technology-driven insurance companies – also known as Insurtechs. InsurTechs trends are changing the length and breadth of how insurance services function. While it initially focused on transforming how business services are delivered, now it aims to transform the entire business model works. Therefore, insurance companies must stay on top of upcoming digital trends in insurance and employ them in their business.Trends transforming the insurance industry Digital processes and operations: Processes have taken on an entirely different dimension with digital technology by unlocking a multitude of avenues and possibilities. Processes like RPA, have reduced cost of claims journey by as much as 30%, a study by McKinsey has stated. However, this was not a case a while ago. Though automated processes drove efficiencies for several years, its high cost of implementation and system risk made reaping its benefits slow. Now, however, RPA technology provides a low-cost, high returns mechanism when deployed efficiently. Though it initially created an impact on high-volume transactions such as personal claims, the development of cognitive and AI patterns have equipped it to deal with complex commercial claims as well. Customer engagement: Life insurance success stories of tomorrow will revolve around organizations that adopt an advice-driven approach enhanced with digital engagements to cater to evolving consumer expectations. Digital engagements include business through digital marketing, online customer journeys and digital underwriting, as well as policy administration and claims through self-service. Digital data management: Improvements in AI and IoT have uncovered new markets and opportunities. Innovations such as home sensors, telematics and drone surveys have the ability to produce critical data to help businesses provide more personalized solutions and take better decisions in underwriting, pricing and claims adjustments. Digital data flows will also help businesses manage customers individually, rather than as a group.

What are the technological trends disrupting the insurance sector?

A report by IBA suggests that there are broadly seven disruptive technology trends that are changing how business is done in the insurance sector. Infrastructure and productivity: Digital innovation needs modern infrastructure. This includes technologically advanced ways of not just functioning and processing, but also computation and storage. Technologies for online sales: Insurers are leveraging the most modern technology to target their right customers, pinpoint the ideal user andanalyzeconsumption. Data analytics: Analytics allows users to gain deep insights on userbehavior, that helps insurers gain insights into customer needs and preferences. IoT: Analyzing data from sensors can help insurers to understand user behavior. Distributed ledger technology: By storing data on distributed ledgers, insurers can greatly improve the time taken for processing. Machine learning: Insurers can use machine learning to manage claims processes, price products and shape underwriting. Virtual reality: Virtual realitycan usethree-dimensional imaging to ascertain how a particular incident happened by reconstructing the environment in which it happened – a room or building – to absolute precision.

Customer journey – traditional insurance vs insurtech

So, what does a customer journey look like with these technological advancements?

To start off, claims filing processes would become a lot easier. Compared with a customer waiting on hold over a phone call to report a claim, a mobile application would make reporting a lot easier and faster. Instead of having to pen down a long and painful notice of loss, an app would ensure quick and easy collection of details with simple Q&As, photo upload and sensors. There’d be superior convenience with regard to communication. Not only will updates be shared as and when they happen, but the customer will also be fully in the loop of claims redressal as compared to a traditional model of calling to follow up. Payments would be made directly to the bank account and triggered automatically on completion of formalities as compared to manual triggering and cheques.

How Insurers Avoid Being Blindsided by Insurtech Disruption

Emerging technologies are being smartly leveraged by businesses to drive themselves forward. However, insurers need to be farsighted and strategic about the technologies they adopt. While it is essential to stay in the competition and keep an eye out to see what competitors are doing, businesses need to carefully analyze their strategies to ensure they are not blindsided by the disruption in insurtech. To do this, insurtech businesses must adopt agile, long-term technology investments, personalization and customization of services, based on a strong and agile technology foundation.

Regulations and insurtech

With the exponential growth of computing power, the insurance domain has been opened up to sophisticated forms of data collection and analysis, including data mining, statistical modeling, and machine learning. These evolving techniques have made it increasingly challenging for insurance regulators to evaluate rating plans that incorporate complex predictive models. To address this issue, insurance regulators are considering various methods of field testing such technologies in a controlled environment. Several US states have indicated they believe their insurance laws contain sufficient flexibility to permit the issuance of regulatory variances and waivers (e.g., no-action letters) to InsurTech firms seeking to test new products without fear of regulatory action, and have encouraged firms to talk to them.

The Future of Insurtech

This said, the future of innovation in insurtech is intertwined with regulations. Any new or innovative change in the insurtech sector would require regulatory approval, therefore insurers and regulators must work together to determine a way of working. Obtaining regulatory buy-in at an early stage is often critical for ensuring a relatively fast and painless regulatory approval process. This can also significantly improve a company’s speed to market. However, regulators should be ready and willing to have a dialogue with the industry on the future of insurance regulation, and companies looking to disrupt the insurance industry should consider taking them up on their offer.

Download Digital Insurance Brochure for Detailed Features

To achieve complete digital transformation in the insurance industry you need a technology partner to guide you through the technology landscape and to help you choose the right strategy. Nuvento’s digital insurance services are a portfolio of services that helps to enhance the operational efficiency of core insurance processes such as finance, procurement, broker management, and customer support while reducing costs and boosting customer as well as employee satisfaction.

Download Our Brochure to Understand the Key Features and Offerings of Our Insurance Digital Transformation service.

View Complete Infographics on Technology and Disruption in the Insurance Sector

Share this Image On Your Site

Embed the below code to share this infographics in your website