A Guide to Using AI in Cybersecurity to Strengthen Business Resilience

...

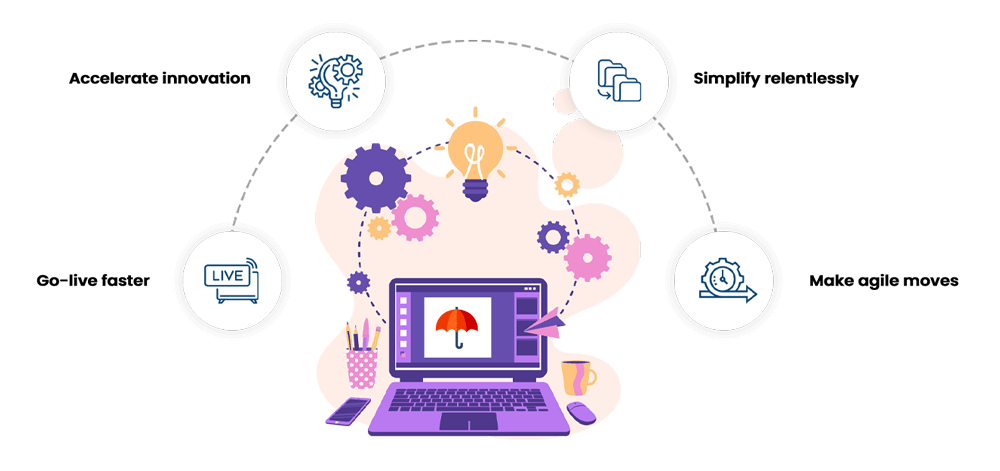

Transformative insurance solutions to fast-track your digital adoption

Digital technology has changed expectations around how solutions are delivered. Everybody wants quick-to-access, fast and intuitive digital experiences that let them get the job done faster and the same goes for insurance customers.

Insurers need to leverage technological solutions that increases the pace of their innovation, helping them deliver truly digital insurance software solutions to their stakeholders as well as their customers. They need to cater to the evolving need of customers with personalized and real-time experiences on the platforms they use.

Enable your policyholders to report an insurable event by making simple conversation with an AI-powered chatbot. The FNOL chatbot is your customers’ digital insurance software solution assisting claims that allows them to report a loss and see it through to a claim in a digitalized mode. Its NLP and ML capabilities grasp the user’s intent quickly.

Once the user expresses the intent to report a loss, the bot can quickly collect the relevant information about the incident such as the name of the insured, insurable event type, location, images and guide the user through the next course of action. The chatbot further gives the customer the required updates regarding the claim and the customer can even get their queries answered without a hassle.

An FNOL chatbot makes it significantly easy for a customer to notify loss without waiting on a phone or a queue. And it can be integrated with popular IM platforms like Facebook Messenger and WhatsApp.

Allow policyholders to access and manage their policy-related information with a policy wallet. With a policy wallet, you can enable your policy holders to avail insurance services through the platform. They can also manage their claims, renew their policies as well as manage and track their policy information.

The policy wallet reduces policyholders’ dependency on the insurance agent/broker for fulfilling insurance-related needs and gives them a channel with self-service capabilities. It enables them to complete any insurance-related need in a few simple clicks without worrying about the hassle of making it to the insurance office and waiting in long queues to get the job done

The assistant to a busy insurance agent, AgentConnect is a powerful cloud-based insurance broker software for insurance agents that handles all the information needed for developing a strong insurance database. AgentConnect can assist agents to stay updated about clients’ information, products, insurance carriers and contacts.

This insurance broker software provides solutions to digitally merge leads’ information and help with the information to pursue leads for agents. The platform automates the insurance lifecycle for agents and powers up their productivity with real-time insights into performance metrics.

AI-powered vehicle damage estimator that allows users to upload images of a damaged car and get an estimate for claim. This digital insurance software leverages image analytics for real-time vehicle damage assessments.

Once the user chooses the car from the app and uploads images of the damaged vehicle, the continuously improving intelligent system immediately processes the image leveraging the trained model and displays the estimate in a few seconds. CarDE is a PaaS offering as well as mobile app which can easily integrated into existing apps.

Request free consultation